How Is Deckers Outdoor Corporation's Stock Performance Compared to Other Consumer Discretionary Stocks?

/Deckers%20Outdoor%20Corp_%20Hoka%20shoe%20by-%20Stefan%20Pinter%20via%20Shutterstock.jpg)

Deckers Outdoor Corporation (DECK), headquartered in Goleta, California, designs, markets, and distributes footwear, apparel, and accessories for casual lifestyle use and high-performance activities. Valued at $17.6 billion by market cap, the company offers its products under the UGG, HOKA, and the Teva brand name.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and DECK perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the footwear & accessories industry. DECK's strengths include a diverse brand portfolio with established brands like UGG and HOKA, direct-to-consumer success, and financial discipline. The company also demonstrates strong financial performance, positioning it as a leader in the footwear and apparel industry.

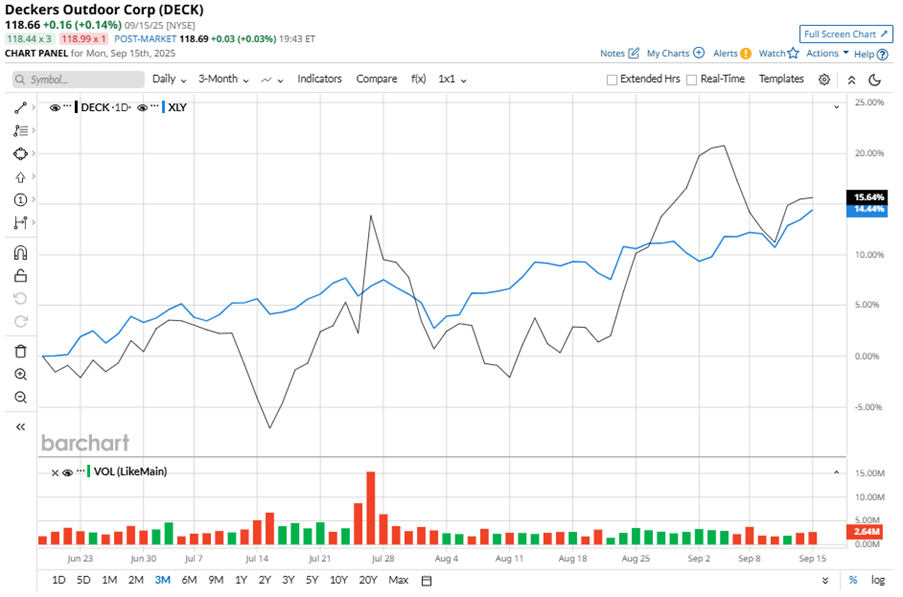

Despite its notable strength, DECK slipped 47% from its 52-week high of $223.98, achieved on Jan. 30. Over the past three months, DECK stock gained 16.9%, outperforming the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 13.7% gains during the same time frame.

In the longer term, shares of DECK dipped 41.6% on a YTD basis and fell 23.9% over the past 52 weeks, considerably underperforming XLY’s YTD gains of 7.3% and 25.1% returns over the same time period.

To confirm the bearish trend, DECK is trading below its 200-day moving average since early February. However, the stock has been trading above its 50-day moving average since late August.

DECK faces challenges, including anticipated $185 million in tariff costs due to potential duty hikes in Vietnam, a 110-basis-point decline in gross margin, and weakness in HOKA's U.S. direct-to-consumer business. Elevated inventory levels and rising SG&A expenses also strain the company.

On Jul. 24, DECK reported its Q1 results, and its shares closed up more than 11% in the following trading session. Its EPS of $0.93 beat Wall Street expectations of $0.68. The company’s revenue was $964.5 million, exceeding Wall Street forecasts of $899 million. For Q2, DECK expects revenue in the range of $1.38 billion to $1.42 billion.

In the competitive arena of footwear & accessories, Crocs, Inc. (CROX) has taken the lead over DECK, showing resilience with a 29.2% downtick on a YTD basis, but lagged behind the stock with 39.8% losses over the past 52 weeks.

Wall Street analysts are reasonably bullish on DECK’s prospects. The stock has a consensus “Moderate Buy” rating from the 24 analysts covering it, and the mean price target of $128.99 suggests a potential upside of 8.7% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.